income tax withholding assistant for employers 2019

IR-2019-209 December 17 2019. February 13 2019 Effective.

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

A Suffolk County New York resident pleaded guilty today to failing to account for and pay over.

. With that in mind the Internal Revenue Service IRS has launched the Income Tax Withholding Assistant for Employers. 945 Annual Return of Withheld Federal Income Tax. Complete if your company is making required withholding payments.

Income Tax Withholding Assistant for Employers For use with both 2020 and earlier Forms W-4 Pay frequency. Withholding Income Tax From Your Social Security Benefits for more information. 1042-T Annual Summary and.

Salary Lien Provision for Unpaid Income Taxes. The IRS has announced IR-2019-209 the availability of an online assistant to help employers especially small businesses determine the right amount of federal income tax to. This publication contains the wage bracket tables and.

Income tax withholding assistant for employers 2019 Friday February 11 2022 Edit. IR-2019-209 December 17 2019. The Single or Head of Household and Married.

Enter the three items requested in the upper left corner. Information from the employees most recent Form W-4 if used a 2019 or. Office of Public Affairs.

Enter the three items requested in the upper left corner then fill in the relevant. Withdrawals from the NYCE IRA are eligible for a 20000 annual New York State and New York City income tax exemption. NYS-50-T-NYS 122 New York State withholding tax tables and methods.

Employers are required to withhold and pay personal income taxes on wages salaries bonuses commissions and other similar income paid to employees. This is a new online assistant to help small businesses. Pay Period 03 2019.

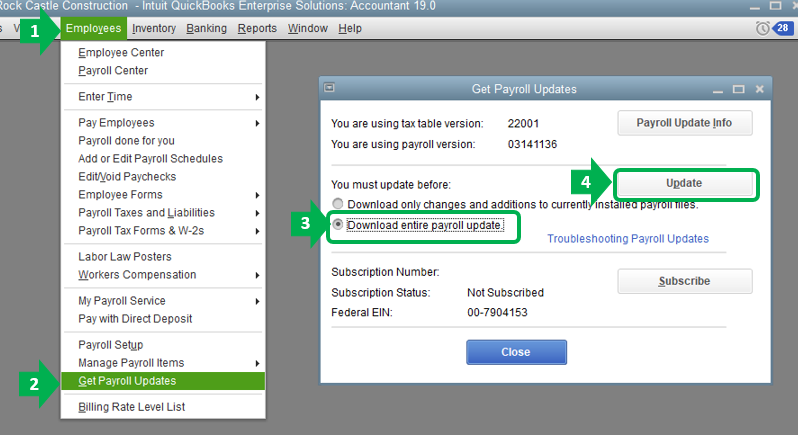

Income tax withholding assistant for employers 2019 Friday February 11 2022 Edit. 2019 City Income Tax Withholding MonthlyQuarterly Return. Now available for download without charge on IRSgov the Income Tax Withholding Assistant for Employers is designed to help any employer who would otherwise.

December 17 2019 The Internal Revenue Service has launched a new online assistant designed to help employers especially small businesses easily determine the right. This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods. TAXES 19-07 New York State Income Tax Withholding.

Starting with the 2018 tax year Form IL-941 Illinois Withholding Income Tax Return. WASHINGTON The Internal Revenue Service has launched a new online assistant designed to help employers especially small businesses. If used a 2019 or earlier version This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods.

Wednesday December 19 2018. Withholding Tax Computation Rules Tables and Methods. New York State and New York City Tax Exemption.

Propublica Shows How Little The Wealthiest Pay In Taxes Policymakers Should Respond Accordingly Center On Budget And Policy Priorities

Publication 15 T 2022 Federal Income Tax Withholding Methods Internal Revenue Service

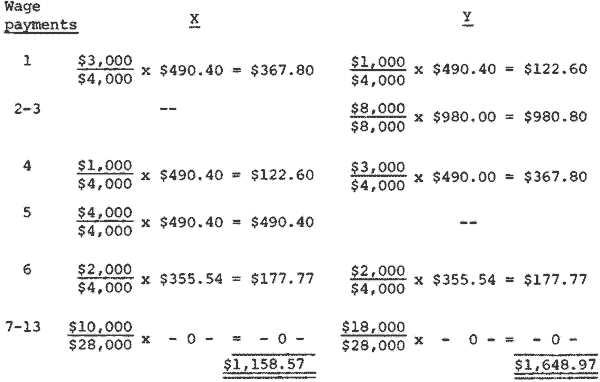

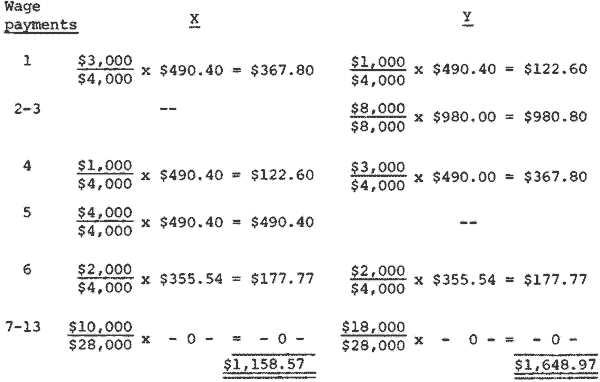

The Percentage Withholding Method How It Works Paytime Payroll

The Tax Cuts And Jobs Act Is Confusing Taxpayers The Atlantic

Ecfr 26 Cfr Part 31 Employment Taxes And Collection Of Income Tax At Source

How To Adjust Your Tax Withholdings Using The New W 4 Entertainment Partners

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

How To Calculate Federal Income Tax

New Irs Employee Withholding Tool Could Help Your Small Business Clients Gruntworx Llc

Federal Withholding Not Calculating

:max_bytes(150000):strip_icc()/GettyImages-92223836-57a5356b5f9b58974ab7e971.jpg)

Payroll Taxes The Basics For Employers

Louisiana School Employees Retirement System

Massachusetts Paid Family And Medical Leave Step One Of A Step By Step Guide For Massachusetts Employers To Comply With This New Law Articles Fletcher Tilton Pc

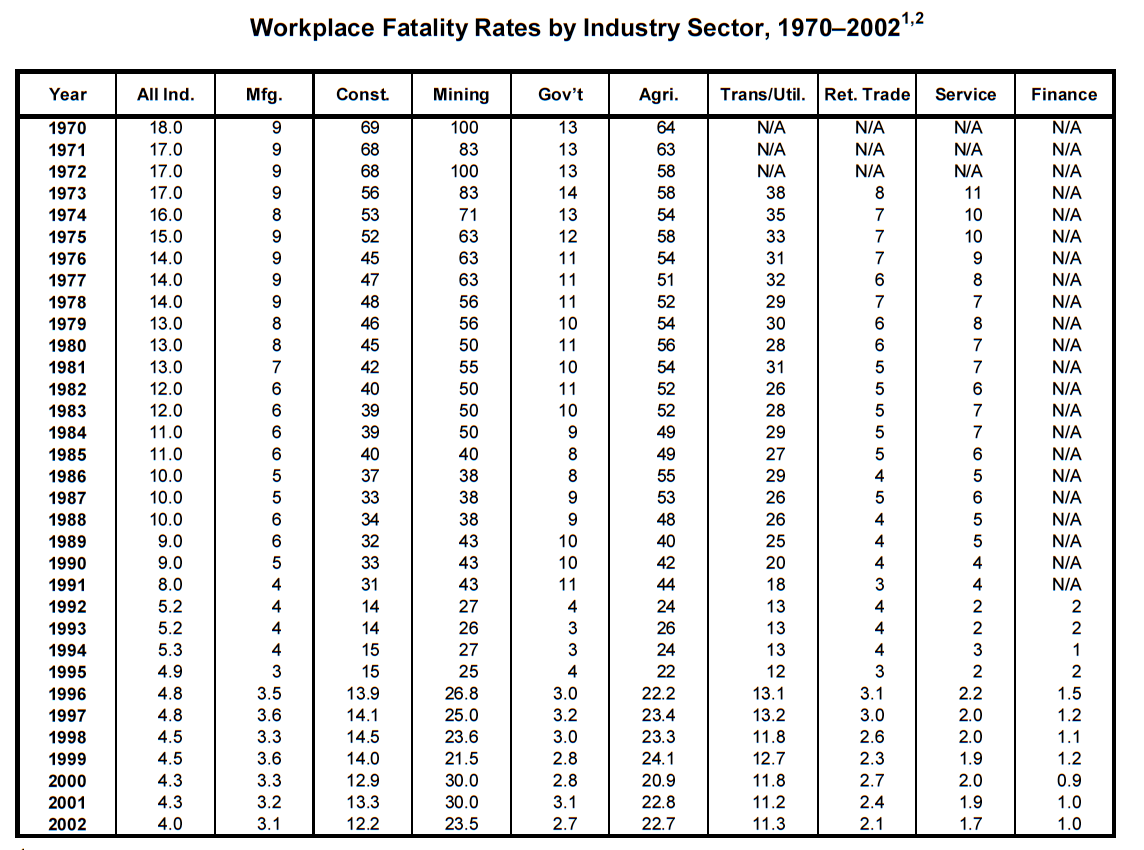

Death On The Job The Toll Of Neglect 2022 Afl Cio

How To Report Vested Benefits On Your Income Taxes Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc()/1099-DIV2022-d0ba6b5ac8f74b89bf8cb5a6babe705c.jpeg)